The growth of investment opportunities in the private markets, or as we call them, Aspirational Investments, has been significant over the past 20 years. The investment industry has seen a proliferation of the strategies and vehicles through which investors can access these private companies, giving rise to a tremendous opportunity for sophisticated clients to greatly enhance their portfolios.

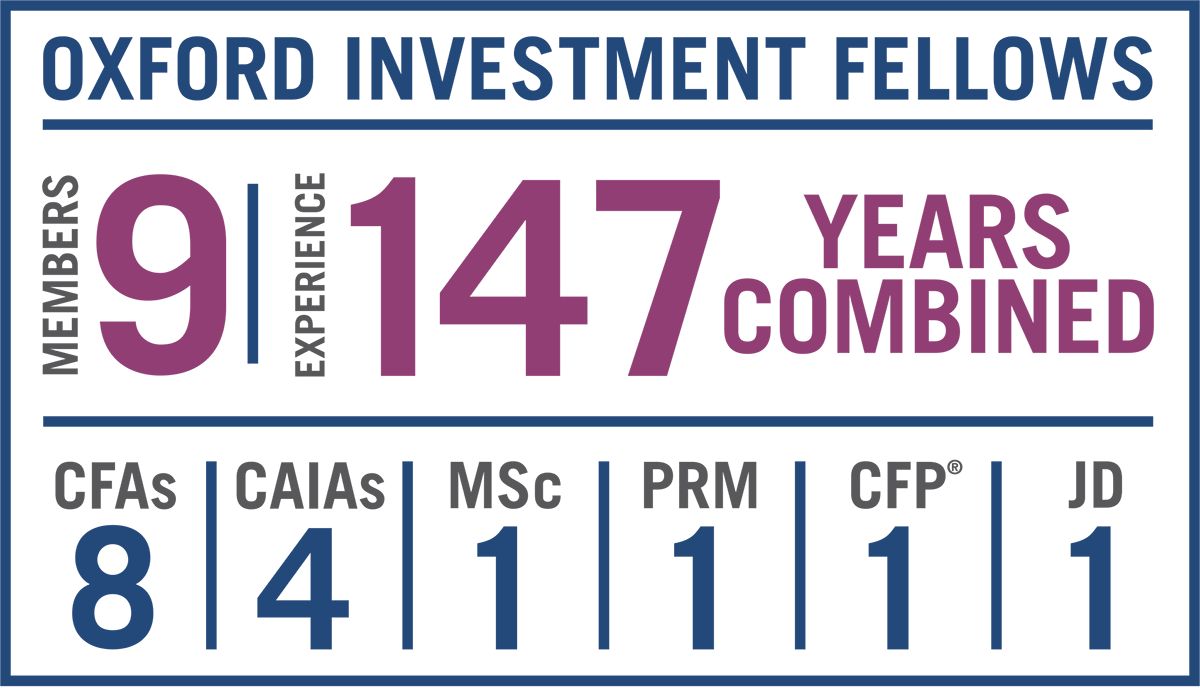

On behalf of our clients, our team of experienced and specialized investment professionals sources and underwrites Aspirational Investments across a number of different strategies and structures. Oxford’s Aspirational Investment Strategies are a way for our discerning clients to access what we believe are “velvet-rope” private investment opportunities. These opportunities can be difficult to access requiring deep, well-established networks. In addition, the strategies and structures are highly complex and require specialist-level expertise to underwrite and negotiate.

Our Regent Street strategy focuses on making select investments with specialist private equity funds that have a strong alignment of interests with their respective limited partners. Through this strategy, our clients gain access to partnerships with talented, experienced investment and operating professionals, employing targeted and specialist strategies in firms early in their maturity with small fund sizes. These attributes lead to a strong alignment of interests between the general partner and limited partners with a strategy that is better positioned to outperform the broader opportunity set.

Through our co-Investment strategy, we are able to make direct, non-control investments alongside our best general partners. We are able to build the portfolio in a targeted manner utilizing our deep skillsets across primary fund investing and direct investing. Our clients benefit from our unique expertise through access to Aspirational Investment partnerships at a beneficial fee structure.

Our Mayfair direct deal investment strategy targets both control and significant minority investments directly into private companies where the Mayfair investment team acts as the lead sponsor in the partnership. We are thematic and focused in our investment sourcing, leaning on our decades of collective investment experience in sectors such as consumer, technology, business services, value-add distribution and niche manufacturing. We have a long-term, partnership mindset that allows us to be true partners with the founders and management teams with which we partner. We are actively engaged at the board and strategic level, while allowing the day-to-day operators the freedom to run the business.

For those wondering if Aspirational Investments are worth the complexity and illiquidity, for many of our qualified clients who are able to hang on for the long-term, we absolutely believe they are. The continued growth of our Aspirational Investing practice here at Oxford has led to an expansion of our team and has also opened the door to even greater opportunities in 2022 and beyond.